You might be glancing at the phrase “Unofficial Guide”.

Yes, it’s – Unofficial! Because the official one belongs to LeadingFile.

And to our concern — LeadingFile is the Ignite Visible India’s largest registrar of companies & secretarial compliances.

Covers all the aspects, likely to be contained – Partnership Firm Registration, Indian subsidiary registration, GST registration for foreigners, and much more registrations, tax filings, etc.

Note: This being a guest post, is not the exact views of our expert.

Next, if you really wish to have the glimpse of ITR and its Verification in detail, then, please do visit the anchor text in blue, illustrated as; ITR-V!

Getting back to the subject i.e, ITR Verification || Download || Check || Send ITR!

Let’s fragment each and every subject, elaborated above –

This is what we are going to tell in detail here. Keep going…

What Is — ITR Verification

Generally, ITR-V combines two words i.e. ITR & V! Both have their meanings and standards, but, together they create a phrase that stands for “income tax returns – verification”.

On the other hand, ITR-V means – a form related to income tax returns – verification.

It is no secret that the ITR-V form is a one-page document that was created by the IT department. Holding an acknowledgment about your returns, whether they are successfully submitted to the Income Tax Department.

Fast Forward – Anyone can get it from the email id linked with the PAN, but only after filing the ITR.

And once the ITR has been filed, the verification phase can be processed. For which the IT department verifies your submission by checking the authenticity of your e-filing and accepting your tax returns and generates ITR-V.

Verification Of ITR

Verification Of ITR can be done in two manners, illustrated as follows;

Hence, if you are doing ITR form filing, then verification of the ITR form is necessary!

Following are the very basic ways of ITR-Verification by which a person can claim his return; Detailed as follows:

An image to illustrate the same is attached from the source – LeadingFile.

This was all about the ITR Verification!

Now, let’s discuss how to download ITR-V.

Note: This being a guest post, is not the exact views of our expert.

Next, if you really wish to have the glimpse of How To Download ITR -V in detail, then, please do visit the official guide on same from the source — LeadingFile. For that, just Navigate LeadingFile >> Blogs >> ITR-V | Learn To Revise, Send, Download & Check ITR-V Receipt Status!

How To Download ITR-V Acknowledgement

ITR-V means income tax return verification and the IT department prepares it to verify the validity of its e-filing for taxpayers.

This is applicable only for those who file without digital signatures. Now it is easier than ever to get your ITR-V in the comfort of your home or office. It has been summarized in the following steps.

Let’s get cracked with the steps…

Step 01: Go to the Income Tax website and log in.

Step 02: Choose “View Return / Form” option to view e-filed returns.

Step 03: Click on the receipt number to download your ITR-V. You can also opt to e-verify your income tax return. For e-verification, select the option “Click here to see pending your return for e-verification”

Step 04: To start the download, select the ITR-V / receipt.

All done with the downloading steps. Now. let’s jump over to the next phase i.e Check ITR-V Receipt Status.

Note: This being a guest post, is not the exact views of our expert.

Next, if you really wish to have the glimpse of Check ITR-V Receipt Status in detail, then, please do visit the official guide on same from the source — LeadingFile. For that, just Navigate LeadingFile >> Blogs >> ITR-V | Learn To Revise, Send, Download & Check ITR-V Receipt Status!

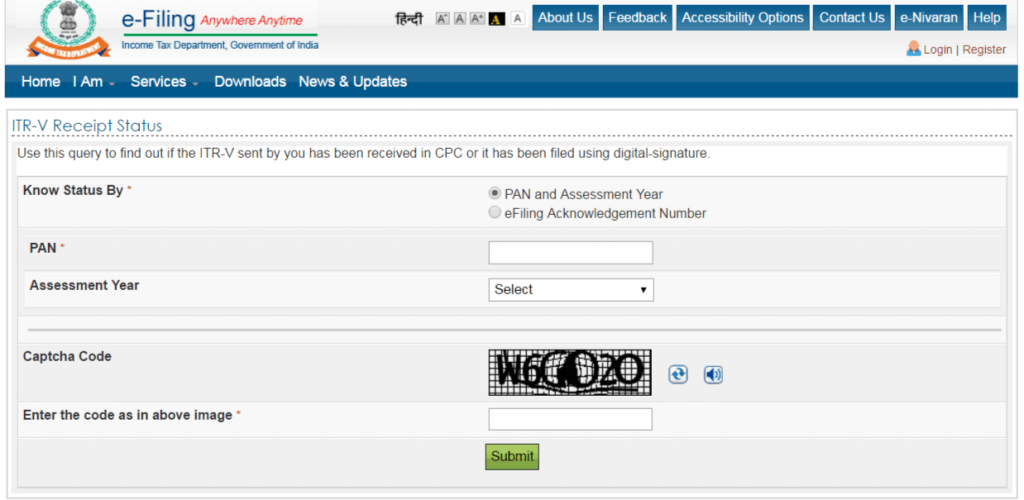

Check ITR-V Receipt Status

If you are filing your return electronically, you will have to send ITR-V to the Income Tax CPR or 120 days from the date of filing of your return or your return will be E-Verify.

The usefulness of checking the ITR-V receipt status is very useful if you have sent the signed ITR-V to the Income Tax Department and want to track the current situation because your refund will be filed only when it is received by the Income Tax Department within 120 days Will be done. From the date of filing.

Let’s get cracked with the steps…

Step 01: Visit https://incometaxindiaefiling.gov.in.

Step 02: Select the ITR Status option under Services from the left side menu.

Step 03: You can track the ITR-V receipt status using your PAN number and Assessment Year or by using eFiling Receipt Number.

Step 04: Enter your 10 digit PAN number and select the assessment year for which you want to track your ITR-V receipt status or enter the e-mail receipt number.

You can get your 15-digit e-mail receipt number on ITR-V.

Step 05: Enter the captcha code and click the submit button.

Step 06: You will get your ITR-V receipt status on the next page which is as follows:

- No

e-return has been filed for this PAN/receipt number –

This somehow means that no returns have been filed or the input you

entered is incorrect. - The

e-return has been digitally signed for this assessment year or

acknowledgment number – This somehow means that ITR-V

has already been verified using the digital signature. There is no need to

send a hard-signed copy of ITR-V to the Income Tax Department. - ITR-V

Received – This somehow means that ITR-V

has been successfully received by the department. - ITR-V

not received – This somehow means that the

ITR-V is not yet received by the department. - Successfully

e-Verified – This somehow means that ITR-V

has been verified electronically. There is no need to send the hard sign

copy of ITR-V to the Income Tax Department.

This was all about the ITR-V receipt status checkup!

Now. let’s jump over to the next phase i.e Send ITR-V Acknowledgement.

Note: This being a guest post, is not the exact views of our expert.

Next, if you really wish to have the glimpse of How To Send ITR-V Acknowledgement in detail, then, please do visit the official guide on same from the source — LeadingFile. For that, just Navigate LeadingFile >> Blogs >> ITR-V | Learn To Revise, Send, Download & Check ITR-V Receipt Status!

How To Send ITR-V Acknowledgement

Feel free to print online with us and send new ITR-V form!

An image to illustrate the same is attached from the source – LeadingFile.

Some best guidelines for printing ITR-V form are as follows:

- The ITR acknowledgment form should be

printed only in black ink, do not use any other ink to print ITR-V. - Second – Only A4 size sheets should be

used while printing the ITR-V form. - Do not use staples on the ITR-V

receipt. - Signature photocopies of the ITR-V

form will not be accepted. - Despite using dot matrix printers, use

only inkjet or laser printers. - The number below the barcode and code

should be clearly visible in the ITR-V receipt form.

So, it was all about the printing schema. Fast forward, if you have any problems during the entire ITR-V work process then go with our support consultant.

Return to the goods; I.e. Send CPC ITR-V to CPC Bangalore!

The entire process of transferring the ITR-V form to CPC Bangalore is not difficult. The only thing that you need to know is the CPC Bangalore address, where you have to send/submit the ITR-verification form.

Well, for the known dialogue, the IT department has allocated a new address to the CPC (Centralized Processing Center) Bangalore.

On the other hand, DOP itself (Postal Department) has assigned a unique pin code (560500) to the CPC. For which the taxpayers can send their ITR-V form and other documents in the centralized processing center through the mail.

But the whole thing can be done only after downloading and printing from the ITR-Income Tax Department’s website. Immediately after downloading, you just have to open it and print it by logging on to the departmental portal.

Fast forward, print the printed ITR-V form to the appropriate address. However, if you are not well aware of the new CPC address then keep going …

Note: CPC-Bangalore new address for speed post –

- Post Bag No.1,

- Electronic City Post Office,

- Bengaluru, Karnataka 560100.

This was all about the printing and sending of ITR-V Acknowledgement.

All done!

Conclusion

Here, in this blog, we have discussed the ~~ ITR Verification || Download || Check || Send ITR — [Unofficial Guide].

Often we concluded its layout and the entire process of downloading, checking, printing and sending ITR-V throughout the steps in detail.

They add value to any blog post. And, this leads to the end of the blog.

We hope this blog helped you. Do share the blog with your peers.